Sustainable Investing

What is

Sustainable Investing?

Sustainable Investing is the active integration of environmental, social, and corporate governance (“ESG”) data in investment decision making.

Sustainable Investing Methodology

Doerschler & Associates’ philosophy to sustainable investing combines all three approaches in order to provide exposure to a global diversified set of investment opportunities, reduce exposure to certain industries and companies, and support companies positively impacting our society.

ESG Investing (Scoring)

Evaluating and scoring companies based on their environmental, social, and governance business practices to identify risks and opportunities. These evaluations can be based on broad ESG performance, and can also be thematic, focusing on specific issues.

Negative Screens

Eliminate exposures to companies or sectors that pose certain risks or violate an investor’s values.

Impact Investing

Seek to achieve a measurable, sustainable outcome alongside a financial return, such as “green” bonds that finance environmental projects like renewable energy

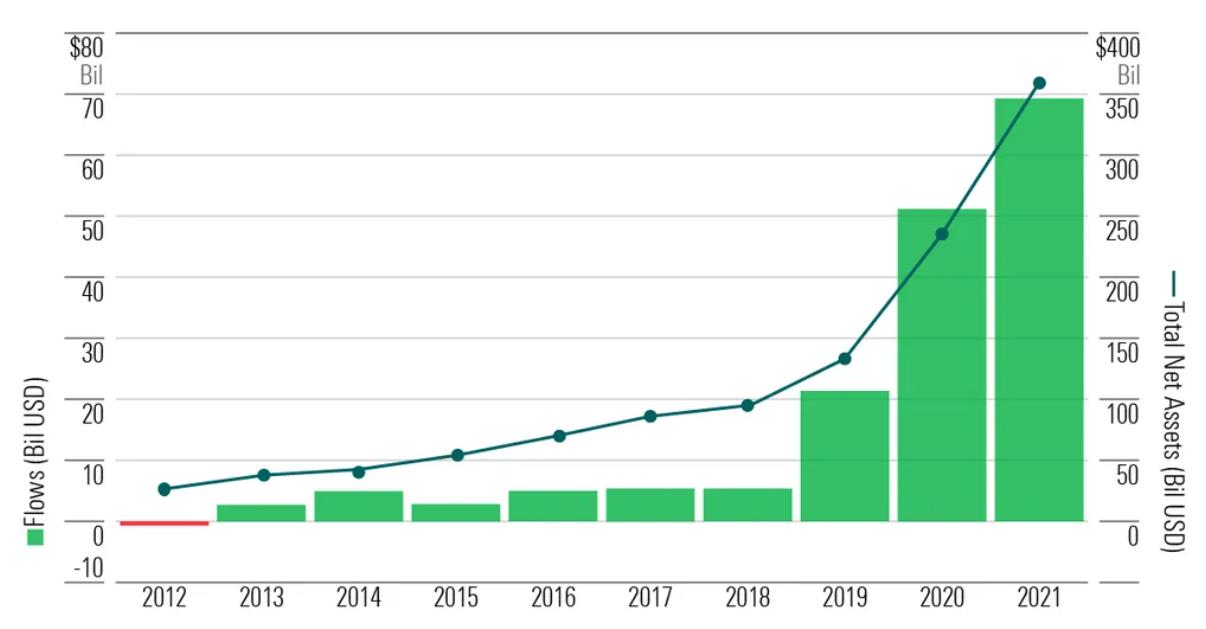

Sustainable Investing Asset Flows

Sustainable Funds Estimated Annual Flows (2012–2021)

Data Sources: Morningstar Direct. This information has been taken from sources, which we believe to be reliable, but there is no guarantee as to its accuracy.